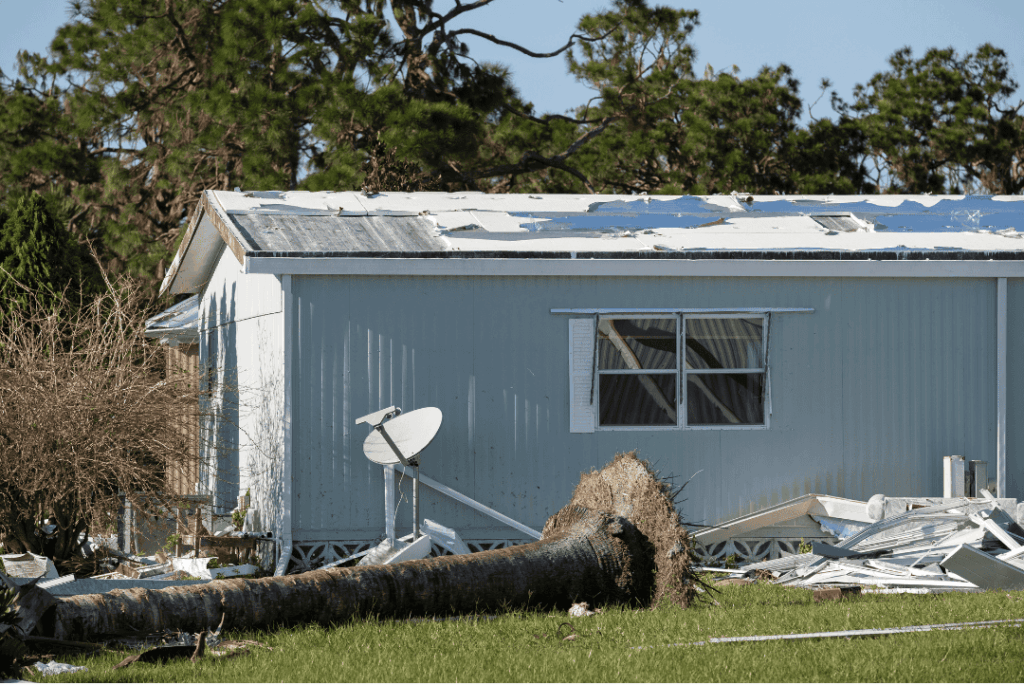

Natural disasters like hurricanes, wildfires, floods, and tornadoes can be devastating for a manufactured home community. Having the right insurance for natural disasters is essential for safeguarding your property, minimizing financial loss, and rebuilding your community. Without the right coverage, a natural disaster could make it impossible to recover.

How Insurance for Natural Disasters Helps Your Community

The right insurance coverage can help your community quickly recover after a natural disaster strikes. Insurance helps by covering damaged infrastructure and community-owned buildings, replacing lost income, paying for extra expenses and more. The financial support during this time can provide the stability your business needs to get back up and running.

Insurance Coverage You May Use After a Natural Disaster

Property Insurance – This coverage protects damage to community-owned buildings and structures, as well as your income stream. This would cover events such as a tornado damaging your office building’s roof, a wildfire destroying equipment and tools in your maintenance shed, or a hurricane blowing down your signage and fencing. Flooding coverage is also available, and almost always offered on a separate policy.

General Liability – This type of insurance covers damages related to bodily injury and property damage allegedly caused by your negligence, with some exceptions, plus legal defense fees. Even outlandish allegations can trigger coverage. After a natural disaster, this could cover things such as a resident tripping and falling over a fallen branch, or a tree falling and hitting a resident or their home or car.

Loss of Income – If your community’s income ceases after a wind or fire storm, loss of income insurance will help replace the lost rental income and and provide extra expense reimbursement while repairs are being made. Coverage can last for up to 12 months during the repair and restoration phase, and another 6 months after the property reopens to give you time to add new tenants.

Flood Insurance – Oftentimes, separate insurance coverage is required for flood damage. This coverage is especially important in high-risk areas. Coverage is offered for buildings as well as loss of income.

Extra Expense Coverage – After a natural disaster, there are often many unforeseen expenses. This insurance helps to cover these costs. Some of these expenses could include emergency repairs and contractors, overtime or hazard pay, generator rentals, temporary office space, and safety equipment.

Community Recovery and Insurance Tips

1) Make sure all buildings and improvements you want covered are listed on your policy.

Forgetting to add a building or improvement to your policy could leave you paying out of pocket for damages after a natural disaster.

Buildings and improvements to add to your policy:

Office Building and Clubhouse

Maintenance or Storage Buildings

Carports

Fences and Gates

Signage

Lighting and Utility Systems

Pools, Playgrounds, and Other Community-Owned Amenities

Community-Owned Homes

2) Your loss of income and extra expense coverage must include a definition that “Covered Property” is the entire location/premises.

“Covered Property” often refers to the items listed in the policy. Infrastructure damage that prevents your property from being occupied, such as utility system or road damage, could cause issues getting loss of income and extra expenses covered if the entire property isn’t listed. Our team specializes in providing insurance to manufactured home communities, so we can help you get tailored, comprehensive coverage for your property.

3) Regular tree trimming and maintenance are essential because most policies only have minimal coverage for tree damage and debris removal.

Fallen trees and branches can cause extensive damage and injuries. Regular tree maintenance can reduce the amount of damage done during a storm and lower your liability. Tree trimming is also important because many policies have limited coverage for fallen tree removal.

4) FEMA is great at debris removal – once you get it to the curb. They are also great at helping residents with housing vouchers.

FEMA can be a great resource for your community. Once you are able to get the debris to the curb, FEMA will collect it. If your residents’ homes were damaged in the storm, they may qualify for temporary housing vouchers or other aid. A great way to help your residents is by providing them with the FEMA representative’s contact information.

5) Advise tenants not to quickly sign up for help with vulture contractors – those that flew in just for the carnage.

After a disaster, there are those who look to take advantage of the situation. Oftentimes, unlicensed and uninsured “contractors” will offer quick-fix services. Encourage your tenants to check certifications and get everything in writing. If you have a list of vetted contractors, provide this to your tenants to help with the process.

For more safety tips for your manufactured home community, visit our resources page here, and learn more in our blog here.